AN uptick in hide prices and increased interest from international buyers has beef processors cautiously optimistic the fortunes of this valuable co-product market might finally be turning.

A few of the high quality hides are showing processors a positive return, bringing between $20 and $30 a piece, market consultant Dennis King has reported.

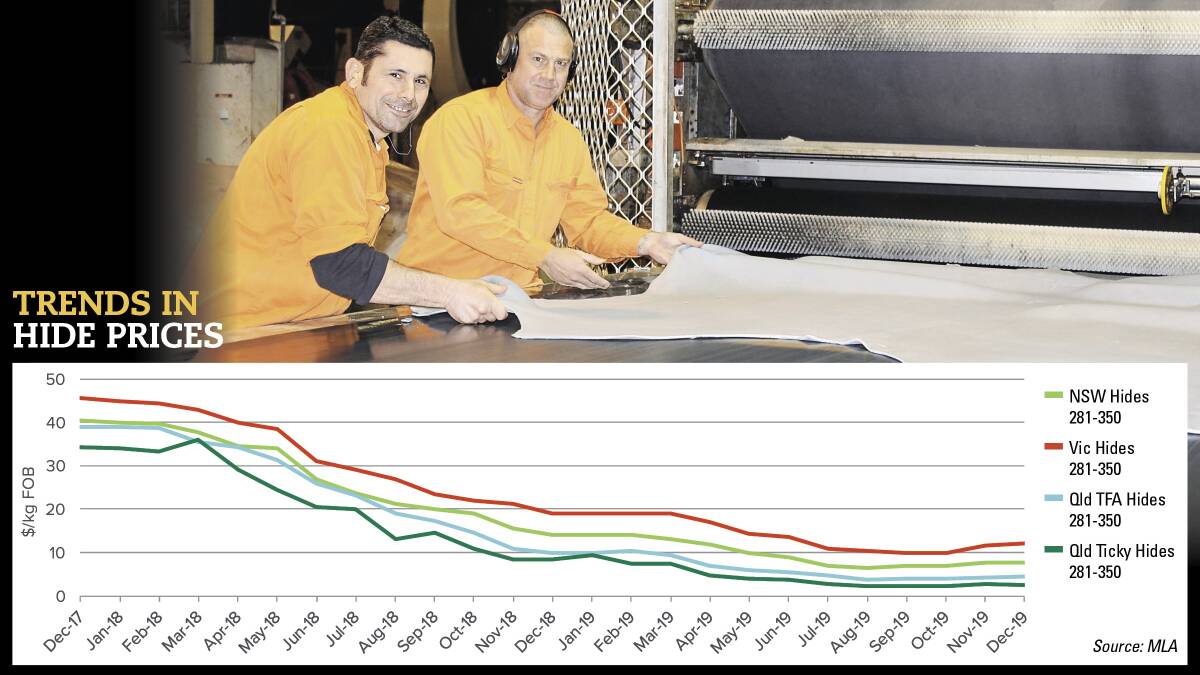

Meat & Livestock Australia's January 2020 co-products report shows good quality Victorian hides traded between 2 and 6 per cent higher in December.

Heavy NSW quality hides traded 5pc dearer and heavy Queensland tick-free hides 2pc.

"There appears to be a lift in leather use in shoes and furniture which is helping to strengthen prices but it is still only a slight market turn - keep in mind good quality hides were bringing $80 to $100 two years ago," Mr King said.

"Small and lesser quality product remains of no commercial value. These won't move until supply of the higher quality product runs out.

"But hides are the standout story in the latest co-products market survey, the area that has some real positiveness to it."

The massive decline in hide values has come on the back of the rise of synthetics in fashion products, particularly shoes, and lack of demand from the automotive and furniture industries.

"Australia has also been part of the collateral damage of US-China trade tensions, which has led to an overall market drop for cars and furniture," Mr King said.

"Tariffs on US hides going to China and on furniture going back to the US has taken a toll."

China is Australia's largest customer for hides, with 95pc of our product going to that market. However, the US is a far bigger supplier.

Mr King believes as prices dipped ridiculously low, interest was rekindled.

He said the upcoming March leather fair in Hong Kong would provide a better read on whether the market would continue to rise and what the demand from China was likely to be going forward. Many Australian processors are expected to attend.

Meanwhile, a fall-off in the price of rumen pillars - used in a number of Asian dishes - is another notable trend, although prices seem to have steadied.

Heavy weight product averaged $16.13 a kilogram in December, which was $4.75 cheaper than December 2018.

Rumen pillars had been at record price levels for a long period, going mostly to Korea, Japan and China.

Blood meal prices are also compressed due to the fall-off in demand from China, which has far less pigs to feed following the devastation of African Swine Fever.

The co-markets report says blood meal averaged $791 a tonne, down $189 year-on-year.

Tallow prices were firmer with continuing strong demand from the bio-fuel market, looking to ensure supply over the holiday period.

In other categories:

- Prices for head meat averaged $4.37/kg, up 22/kg from year-ago prices and 17/kg above the previous month.

- Cheek meat was $1.18/kg dearer than year-ago levels, averaging $7.04kg, which was 37/kg up from last month.

- Lip export prices to the US and Mexico firmed 17c/kg month-on-month, to average $3.40/kg. Halal lips averaged $3.50/kg, 20c/kg higher than December 2018.

- Omasum eased 30c/kg from the previous month, to average $6.03/kg.

Start the day with all the big news in agriculture! Click here to sign up to receive our daily Farmonline